Is Selling Online a Taxing Proposition?

As an online merchant, do you hate the task of collecting and remitting sales tax to the appropriate taxing jurisdictions based on your nexus of operations? Do you even know what a nexus of operations is? Do some of your products have different tax rates within the same state? Are you concerned that the Marketplace Fairness Act will pass the House of Representatives and you will have a much larger tax-collecting burden?

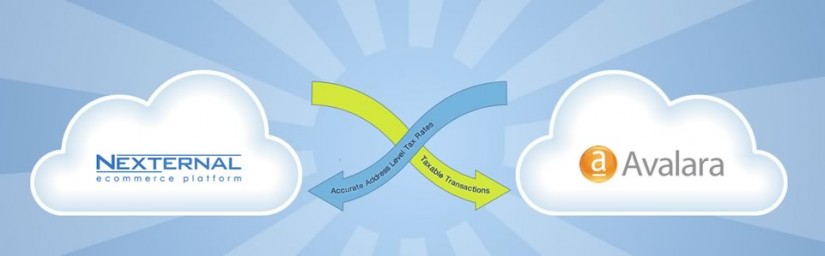

If you answered yes to any of the above, consider a subscription to Avalara to take all of the above off your plate. Avalara ensures that you are charging the appropriate sales tax rate on your products and that your tax collections are remitted automatically when they are due.

Not only does Avalara simplify your tax collection, it also submits the necessary forms and payments to the appropriate tax jurisdictions. Your tax paperwork becomes a thing of the past. The key to Avalara is an integrated eCommerce platform like Nexternal. When shopping for a compatible eCommerce system, be sure that is has a states filter so that you can pre-select which orders get sent to Avalara for compliance. This is native to Nexternal’s integration and can greatly reduce the cost of an Avalara subscription. A system like Nexternal will not only make tax hassles a thing of the past, it will ensure that when you use Avalara, you only pay for the transactions that are necessary. Not all of them.